Forex trading, also known as foreign change trading or currency trading, may be the global marketplace for buying and selling currencies. It runs 24 hours per day, five times weekly, allowing traders to participate on the market from everywhere in the world. The principal aim of forex trading would be to make money from fluctuations in currency change prices by speculating on whether a currency pair can increase or fall in value. Individuals in the forex industry contain banks, financial institutions, corporations, governments, and individual traders.

One of many critical top features of forex trading is its large liquidity, meaning that large volumes of currency can be bought and offered without considerably affecting change rates. That liquidity ensures that traders may enter and leave jobs rapidly, enabling them to take advantage of even small value movements. Additionally, the forex market is extremely accessible, with minimal barriers to access, allowing individuals to start trading with somewhat small amounts of capital.

Forex trading offers a wide range of currency couples to deal, including major sets such as for example EUR/USD, GBP/USD, and USD/JPY, in addition to slight and amazing pairs. Each currency couple represents the exchange charge between two currencies, with the very first currency in the pair being the bottom currency and the second currency being the offer currency. Traders may make money from equally increasing and falling areas by taking extended (buy) or small (sell) roles on currency pairs.

Effective forex trading takes a stable knowledge of simple and specialized analysis. Essential examination requires considering economic signs, such as interest rates, inflation costs, and GDP development, to measure the underlying power of a country’s economy and its currency. Technical evaluation, on the other hand, involves considering price maps and designs to identify trends and potential trading opportunities.

Chance administration is also necessary in forex trading to protect against potential losses. Traders frequently use stop-loss requests to restrict their downside chance and employ appropriate place sizing to ensure no industry can somewhat impact their overall trading capital. Furthermore, sustaining a disciplined trading strategy and controlling thoughts such as greed and fear are essential for long-term accomplishment in forex trading.

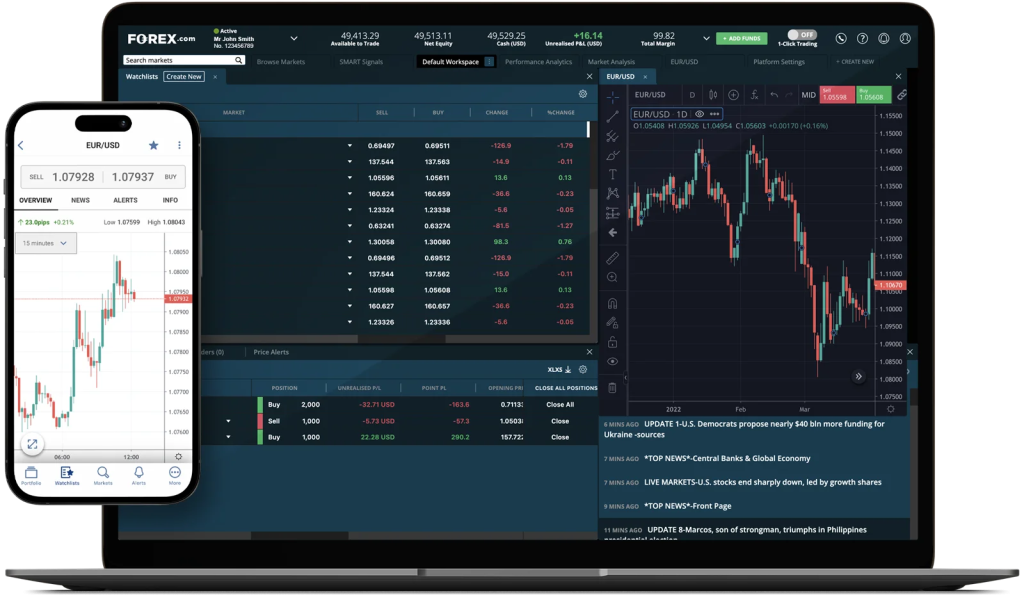

With the growth of technology, forex trading has be accessible than ever before. On the web trading systems and portable applications offer traders with real-time use of the forex industry, letting them accomplish trades, analyze industry knowledge, and handle their portfolios from any device. Furthermore, the accessibility to educational forex robot resources, including tutorials, webinars, and test accounts, empowers traders to produce their abilities and improve their trading performance around time.

While forex trading presents significant profit potential, it also provides inherent risks, including the prospect of significant losses. Therefore, it is essential for traders to conduct thorough research, create a sound trading strategy, and continuously check industry conditions to produce educated trading decisions. By adhering to disciplined chance management techniques and keeping knowledgeable about international economic developments, traders can enhance their odds of success in the powerful and ever-evolving forex market.